We routinely receive checks from American clients. Checks are deeply embedded in American culture as they often have company logos and branding emblazoned on them. Some of them are understated, and others are colorful; a work of art. You can tell American companies are proud of their checks.

In Australia, it is quite the opposite. Banks and their staff here disdain checks. Also known as “cheques”, they see them as a costly, unnecessary part of doing business. That is why the cheque system in Australia has seen a dramatic decline since the 1980s and cheques are set to disappear entirely by the end of 2019.

Even in traditionally high usage countries like USA, Canada and France, checks have experienced a heavy decline and in Holland, they were eliminated completely by July 2001. There are children today who do not even know what a check is.

Every time we receive a check, either I or our other director heads off to the Commonwealth Bank to deposit it. It is an arduous task and it is important to be armed with takeaway coffee in hand while you wait.

There’s waiting in line to be served.

Being told to wait until they find someone suitable to deposit said check.

Waiting while they bumble their way through the paperwork and process associated with the deposit.

Thank goodness for Starbucks when you are forced to wait

The average time waiting was about an hour. The longest we’ve experienced was nearly 2 hours! We started off in our local branch which is mostly a consumer bank. We’re situated where predominantly the older generation live. Some may think that grandmas and grandpas would still have a love affair of the check. Nope. Our senior citizens are hip and cool with digital banking, or they simply join the line at the bank adding to the excessive wait times.

Complaining to staff about the poor experience and threatening the bank manager that “we will leave” didn’t work. They didn’t care, we were just another number. Their customers are primarily the older folks living in the nearby retirement villages, a booming industry in our little town. So much for the council wanting to bring jobs back to our region.

After one of my “friendly” interrogation sessions with local bank staff, a lovely lady suggested that I go to a business bank in the city. There was relief on both of our faces. However, after arriving at the city branch—which has a dedicated Foreign Exchange center—they too were perplexed with the checks.

Other people in line had wads of colorful notes in different in currencies. Their transactions were easy as pie. I had my colorful pieces of paper too, that our customers are so proud to exchange for our services. My transaction was not so easy though. I sipped my Starbucks decaf Vanilla Sweet Cream Cold Brew. And I waited…

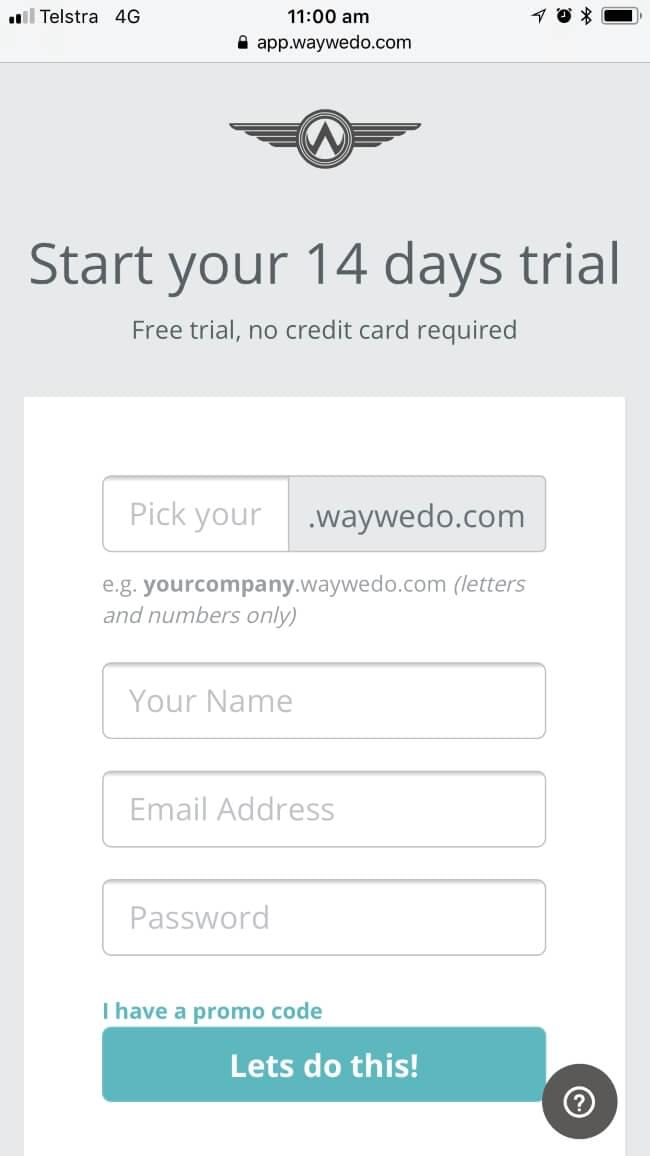

A procedure and process system

The saving grace is that the Commonwealth Bank has a procedure and process system similar to Way We Do’s process management software. The tellers conduct searches to find procedures on how to deposit foreign checks and other tasks that needed to be done. They follow the step-by-step instructions—but they still needed to bring in a second person when the computer system does not do what the procedure instructs. Without their procedures, they simply would not be able to process the payment.

However, the point of this article is not about the usage and depositing of checks, but rather the customer experience when carrying out this task and how it poor processes cost both of our organizations.

Time equals money

Depositing the checks takes time—for me and for the bank—and that costs money. Here’s a break down of how much time and money went in to the process from start to finish.

My Time

Drive time to and from bank – 25 minutes

Parking fee – $41 for 1 hour, $70 for up to 2 hours

Starbucks Beverage – $4.80 (discretional, but helps with my sanity)

Wait Time – 1 hour

Check Deposit Fee – $25

The Bank’s Time

Staff Member 1 – 1 hour

Staff Member 2 (usually a manager) – 30 mins

The average bank teller employee is paid $22.81 per hour and the average bank manager is paid $41.50 per hour. Their time for the hour and half was approximately $43.56. The cost for our company was way more, with car parking alone almost matching their $43.

During my last visit to the bank, I kept a track of time and it was almost at the hour mark. If we go over the hour mark, by even one minute, the car park fee will almost double.

As they were working out the usual computer problems and after the manager apologizing multiple times, I kindly asked, “Do I have be here? Can I go and you call me if there are any issues?”

It dawned on them, in that moment, I didn’t have to be there. They confirmed my contact details and let me go with a printed receipt. I even made it back to the carpark with one minute to spare!

May we suggest a process improvement idea?

So, checks are dying in Australia, but not dead as yet. In the meantime, it still costs the banks and their customers money in wasted time by lack of training and including the non-added-value of customer wait time as a step in the process. By removing the wait time for the customer, it saves them time, money and delivers a better experience. A customer should not have to wait while the supplier does the paperwork.

If the procedure provided better instructions, it would likely reduce the amount of time required by the bank teller and would remove the need for a supervisor or manager to be involved. If the processing time was reduced from 1 hour to 30 minutes for the bank teller, the cost would be $11.40 and they would save $32.16.

In December 2018, the number of checks processed in Australia was at an all time low of 3,000. If the average saving per check is $32.16, that means banks would save $96,480. Of course, this is an insignificant drop in the ocean for a bank; however, if this one process is an indicator that other possible processes in the company are leaking cash, wasting resources and alienating customers, then it should be reviewed formally.

This is a lesson for other organizations, no matter what size you are. Refining processes can save you money, help you retain customers and reduce the risk of damaging your brand’s reputation. Here are a few questions to ask yourself.

- Which processes in your company are causing unnecessary wait times for customers?

- What steps of the process can you remove to provide a better customer experience? For instance, in my case, they could have done the necessary processing without my having to wait.

- Which processes are broken or out of date, and cause staff to bumble their way through and have to resort to disrupting other team members?

- What additional training does your team need so they know how to manage a legacy system and products that are on their way out?

- What old technologies and systems will soon will be replaced by new ones? How will you transition them, and what new processes, systems and training will your team need?

Of course, these are just a start. The more you think about your current systems and analyse your processes, the more questions you’ll no doubt come up with. And if you need help with any of them, Way We Do is in your corner! (We’ve felt the customer’s pain and the business’s pain, first hand.)