End-of-Month (EoM) closing processes happen at the end of every financial period. Typically carried out by Accounts Payable (AP) team, they include recording and managing your business data, and are meant to keep your financial statements accurate and consistent. The usual run-of-the-mill EoM Closing can be considered a frustrating and time-consuming chore that few look forward to with any glee. It’s an attitude fed by a raft of problems commonly faced by those responsible for the task, each and every reporting period. Here are some of the top contenders for inducing dread.

1. Procrastination

This is a nasty one that gets in everyone’s way. Sure, it’s easy to put off your accounting tasks just a little longer, but the consequences can be worse as a result. Time can quickly slip away when you put off things that should be going into your schedule, and before you know it, you’re under pressure from all quarters to get the job done at the last minute. Plus, there are knock-on effects, many of which you can read about below.

2. Reporting inconsistencies

Ideally, your reporting should be happening on an ongoing basis throughout the month. However, some organisations don’t compile their transaction reports consistently; some don’t update things until the end of the month. This approach creates other problems, like unreported transactions and missing documentation that the Accounts Payable team then have to spend further time on rectifying.

3. Accounting and reporting practices aren’t scalable

While most of us go into business with the intention of creating growth, many business owners forget that their systems also need to grow along with the business. While spreadsheets and manual entry processes may be okay for a one-person business, the wheels are going to start coming off once that business begins to grow beyond four or five people.

4. Late or infrequent reconciliations

Frequent and timely reconciliations help you identify problems before they get out hand. They tell you how much you have available, and help you spot any catches, fraudulent activity and bank errors. The reverse is the case when reconciliations are left until the last minute. Irregular reconciliations can present payment issues for your employees and suppliers due to delays.

5. Late and wrong entries

As with any people-based task, particularly one that is time critical, it’s reasonable to expect errors to be introduced. Whether it’s because you started your closing late, your team is overloaded, or data was entered incorrectly, it can take longer to solve any issues that arise as a result.

6. Lack of standardized procedures

Every business relies heavily on a set of standard operating procedures, particularly the process you use at the end of every finance reporting period, to record and manage data. A lack of well-documented processes means staff won’t have the information they need, or the instructions to guide them in reporting and completing transactions accurately. Standardized procedures articulate the organization’s basic expectations for employees. When it comes to your EoM close, documented policies and procedures can help them record purchasing, claims, and expenses correctly, on time, the first time. With no standardization, you’ll have no clear visibility of where your employees are spending company money. Your teams won’t know who to get approvals from, or what supporting documentation to file, leaving your Accounts Payable team with missing entries to search down at EoM.

Tips for solving those EoM Close headaches

1. Set appropriate timelines

Some of the problems we just listed can be solved with better timing and prioritisation. List out all the activities you need to do to for your EoM reporting, and prioritise them in the order they need to be completed. This will help you create a schedule for what needs to be done when, and make sure you put that in your processes and checklists. Remember to add in enough time to deal with any issues that may pop up as well, so you’re not caught off guard or discouraged. With a schedule in place, you’ll find yourself procrastinating less and completing tasks earlier.

2. Set realistic expectations

As a busy business owner, you may expect all tasks to be done yesterday for things to keep running smoothly. This can’t be said for EoM close though, because successfully completing this process depends on several other activities happening first. Everyone in the business has a responsibility to complete their own tasks to progress your EoM close to a successful end. When you’re creating an EoM close schedule, make sure you’re building it along a realistic timeline so everyone has time to complete their contributions accurately and without any undue stress.

3. Train well and often

Everyone in your finance team needs to be trained across all critical activities of the EoM, so you don’t have to rely on just one person all the time. Extend some of this training beyond your accounting team as well, to help other employees understand how their work supports and impacts on the EoM process, and the business as a whole. Training might be in the form of documenting new procedures and processes, how to use systems for reporting, and what data to capture.

4. Implement frequent reconciliation practices

Regular reconciliations provide a form of review as they will highlight where things have gone wrong and where things have gone right in the business. Carrying out more frequent reconciliation activities also means less work come EoM time, and only having to make a few final adjustments. Reconciling more often will also help you identify issues sooner so you can respond more quickly. A well-documented reconciliation process will help you maintain your financial records’ integrity. Use Way We Do’s Activated Checklist feature to outline your reconciliation process. You can also create frequent schedules for your finance team to help keep things running to time.

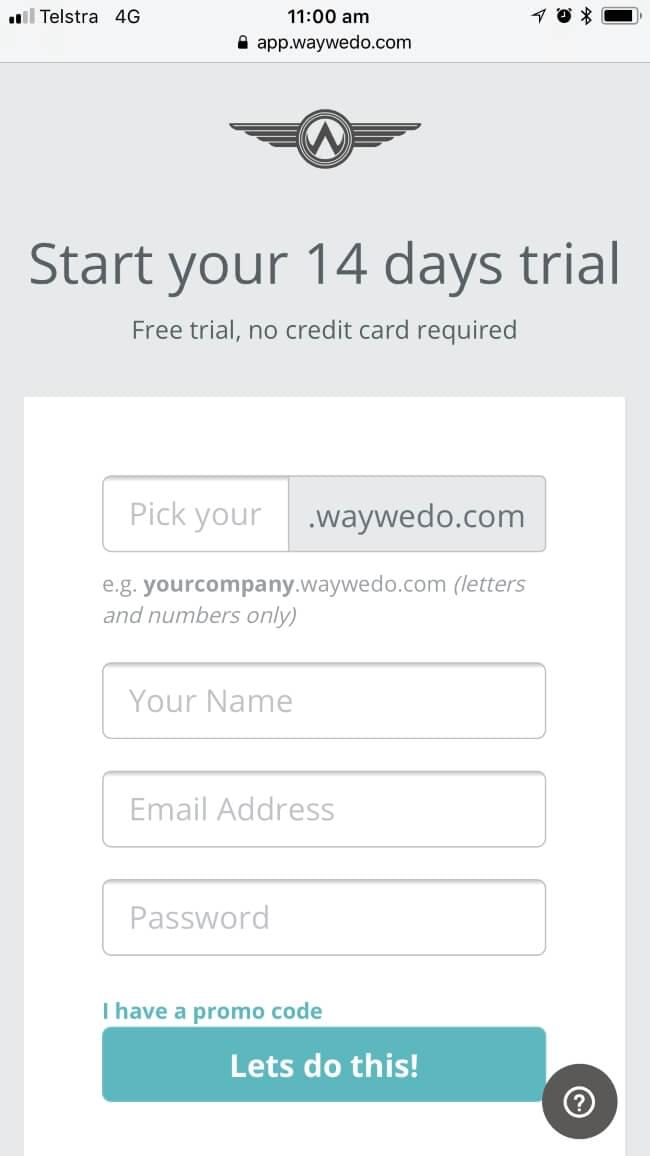

5. Document your EoM Close processes and procedures

Documenting your company procedures and processes is critical. Clear documentation that’s easily accessible to everyone in your team means you’re all on the same page when it comes to company expectations and obligations. Good documentation helps your employees complete processes — like financial reporting — accurately and consistently. Use Way We Do to create procedures and processes for your internal controls. These controls can act as safeguards to prevent errors and fraud, and ensure timely reporting. Make sure your employees are aware of the procedures by enabling active criteria such as acceptance and responsibilities, to drive accountability.

6. Use systems

One mistake small business owners often think is that they are too small create and use systems. Size should never be a barrier to your adopting a more efficient and streamlined approach to completing tasks. Systems can help you standardize and streamline your processes so employees can complete financial processes accurately. Spreadsheets and Journals can be good for managing and making entries, but they are time-consuming and tedious to manage.

Using an accounting system can make data entry and reporting simpler for you and your employees. They also keep your data is safer and make it easier to transfer information transfer when the need arises. You can also take advantage of automation to integrate some of your crucial EoM activities with your processes, initiating tasks on schedules dates, or transferring data files to your accounting systems.

Come along to one of our fortnightly Automation Basics webinars to find out more about how integrating Way We Do and other applications can streamline your EoM Close and other procedures.

7. Hire help where needed

Stay alert to your team’s workload and be ready to enlist some extra help before things overwhelm them. Asking for help early in the process can make things more manageable for your team. Leaving it too late can be counter-productive, adding to the problems we’ve talked about here, and adding to your costs.

Planning Ahead

The premise of the EoM Close process is to reconcile all accounts every month. Each takes time, and there’s the added pressure of getting it right the first time around as the overall result gives a clear picture of the company’s health. Early planning and scheduling should incorporate a central closing process for all team members to collaborate on. This will provide much-needed visibility on what tasks need to be completed for the EoM. Using systems will make it easier to collate relevant documentation and prepare accurate reports. Systems also remove the need for manual data entry, reducing the risk of human error. By implementing firm timelines and effective procedures, you can ensure your team have all the necessary information in place to wrap up each closing period. Worry free.

With the right procedures and resources in place, you can take the sting out of EoM Close time. And you can be confident your EoM reports will give you the financial information you need to make good decisions for your business.